TYKR Stock Screener Review

TYKR Introduction

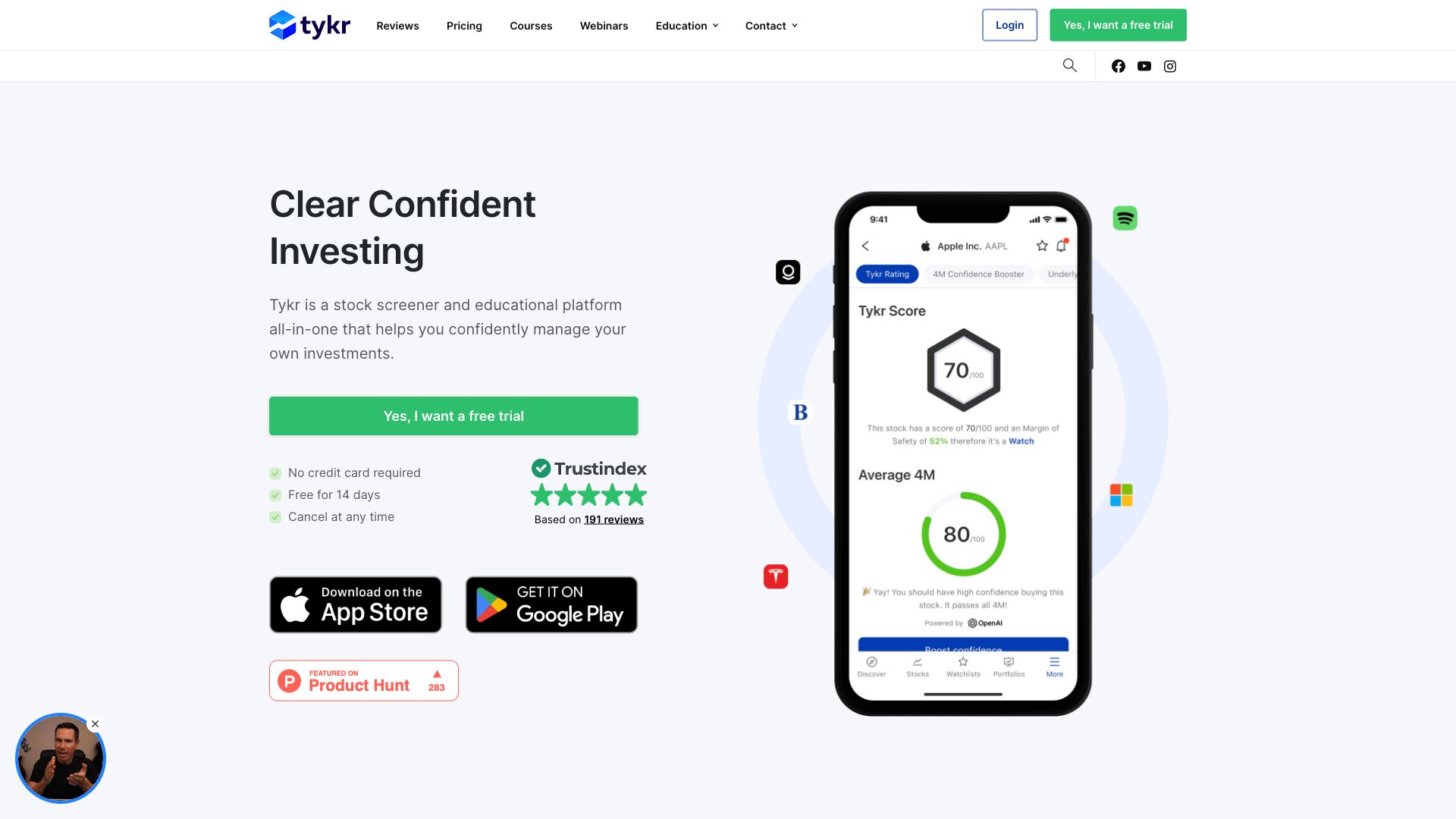

TYKR is a stock screening and analysis tool designed to help both beginner and experienced investors make more informed investment decisions. It simplifies the process of finding potentially undervalued stocks by analyzing financial data and assigning each stock a score based on its financial strength, valuation, and dividend history.

TYKR Features

- Stock Screener: Filter stocks based on various criteria like market cap, sector, industry, financial metrics, and TYKR score.

- Stock Summary: Get a quick overview of a stock's financial health, valuation, and dividend information, along with a TYKR score breakdown.

- Watchlist: Create and track custom lists of stocks you're interested in.

- Education & Support: Access educational resources, tutorials, and customer support to help you use the platform effectively.

TYKR Advantages

- Simple and Easy to Use: Designed for investors of all levels, with a clean and intuitive interface.

- Data-Driven Approach: Uses a quantitative approach based on publicly available financial data to evaluate stocks.

- Focus on Value Investing: Helps identify potentially undervalued companies with strong financials.

- Educational Resources: Provides educational content to help users understand its methodology and make better investment decisions.

TYKR Price:

TYKR offers a free plan with limited features and paid plans with more features and data. Check the website for current pricing details.

TYKR Use Cases

- Finding Undervalued Stocks: Identify potentially undervalued companies for investment opportunities.

- Managing Risk: Assess the financial strength of companies before investing.

- Dividend Investing: Find stocks with a history of paying dividends.

- Learning About Investing: Use the educational resources and data analysis tools to improve investing knowledge.

TYKR Frequently Asked Questions

What is TYKR?

TYKR is a stock screening and analysis tool that aims to simplify the process of finding potentially undervalued stocks. It uses a quantitative approach based on publicly available financial data to evaluate stocks and assigns each stock a score (the TYKR score) that reflects its financial strength, valuation, and dividend history.

How does the TYKR score work?

The TYKR score is a composite score calculated based on three main factors:

- Financial Strength: Evaluates a company's financial health using metrics like debt levels, cash flow, and profitability.

- Valuation: Determines whether a stock is potentially undervalued or overvalued based on metrics like price-to-earnings ratio (P/E) and price-to-book ratio (P/B).

- Dividend History: Considers factors like dividend yield and dividend payout ratio for investors seeking dividend income.

Is TYKR suitable for beginners?

Yes, TYKR is designed to be user-friendly and accessible for investors of all levels, including beginners. The platform provides educational resources and a straightforward interface to help users understand its methodology and make informed investment decisions.

What are the limitations of TYKR?

While TYKR provides valuable insights based on financial data, it's important to remember:

- Past performance is not indicative of future results. The stock market is inherently unpredictable.

- TYKR should not be the sole basis for investment decisions. Conduct your own research and consider other factors before investing.

How accurate are the stock ratings on TYKR?

The accuracy of the TYKR score is subject to the limitations of the data used and the inherent uncertainties of the stock market. While TYKR aims to provide reliable insights based on quantitative analysis, it's essential to remember that no stock evaluation system can predict future stock performance with certainty.

What is the best way to use TYKR for investing?

Use TYKR as a starting point for your investment research.

- Screen for stocks that meet your criteria. Use the filters to narrow down your search based on your investment goals and risk tolerance.

- Conduct further research on potential investments. Analyze the company's financials, read news articles, and consider other factors beyond the TYKR score.

- Make informed investment decisions based on your overall assessment. Don't rely solely on the TYKR score; combine it with your own due diligence.

TYKR Price and Service

- Visit the TYKR website for up-to-date pricing information on their free and paid plans.

- TYKR offers customer support and various educational resources to help users get the most out of the platform.